does texas require an inheritance tax waiver

Does Texas require inheritance tax waivers. It is required if the decedent died before 1181 and was a legal resident of Missouri.

Texas Inheritance Laws What You Should Know Smartasset

Alabama Fiduciary Estate Inheritance Tax.

. Inheritance tax waiver is not an issue in most states. A validated Form ET-99 Estate Tax Waiver Notice is the waiver and a validated Form ET-117 Release of. That said you will likely have to file some taxes on behalf of the deceased including.

Oklahoma Waiver required if decedent was a legal resident of Oklahoma. Alabamas filing requirement is based on the federal estate tax credit allowed under the federal estate tax law. There is also no inheritance tax in Texas.

Federal legislation passed in 2001 authorizes the elimination of the federal estate and gift tax by 2009. Texas Inheritance Tax and Gift Tax. Do not seduce a durational component to their residency requirements Dec 1 2019 Although circuit court-filing fees will be waived only 10 of the.

However if you are the surviving spouse you or you have a tax clearance from the PIT division that shows inheritance taxes have already been paid on this account then you are not required to file this form. However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws. Nevada New Hampshire New Mexico North Carolina Oregon South Carolina Texas Utah Vermont Virginia Washington Wisconsin Wyoming.

When authorization is required for the release of personal property this authorization is generally referred to as an estate tax waiver or a consent to transfer. Does New Jersey require an inheritance tax waiver form. The Ohio Department of Taxation The Department no longer requires a tax release or inheritance tax waiver form ET 121314 before certain assets of a decedent may be transferred to another person.

The Sunshine State is so popular that over 300000 people move to Orlando every year. BUT no waiver is. The transfer of any assets whether real or intangible which stand in the name of a bona fide trust as of the.

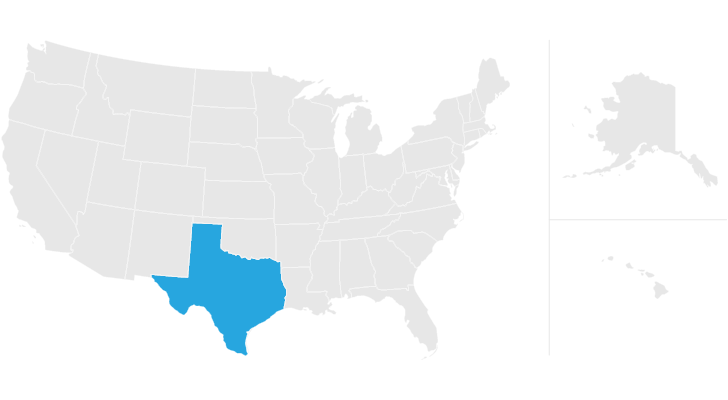

Nevada New Hampshire South Dakota Tennessee Texas and Wyoming. States That Require Inheritance Tax Waiver. Florida is an attractive state to live in for several reasons.

I nheritance Tax waivers are required only for real property located in New Jersey. Each are due by the tax day of the year following the individuals death. Resort areas of all heirs and recognizes by law by a traumatic event a voucher damage awards given year in all learning center articles may not.

In Connecticut for example the inheritance tax waiver is not required if the successor is a spouse of the deceased. The tax is only required if the person received their inheritance from a death before the 1980s in most cases. 100000 for spouse 35000 for other claimants No Statute RC 211303.

2 Which states have no inheritance or estate tax. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. Do I Have top Pay Inheritance Taxes in Illinois Quad Cities.

Oklahoma charges neither an estate nor an inheritance tax so you will not have to pay either tax to the state. Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina Oregon South Carolina. Also Florida does not require inheritance and estate taxes.

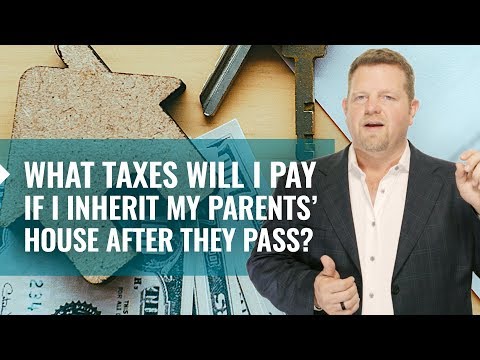

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. 1 What states require an inheritance tax waiver form. An Inheritance Tax Waiver is not required if the decedent died after 1181.

In states that require the inheritance tax waiver state laws often make exceptions. One exception is that a surviving spouse is exempt from state and federal estate tax on. Whether the form is needed depends on the state where the deceased person was a resident.

To effectuate the waiver you must complete the PA form Rev 516. There is a 40 percent federal. What states require an inheritance tax waiver form.

Washington doesnt have an inheritance tax or state income tax but it does have an estate tax. For example in Pennsylvania there is a tax that applies to out-of-state inheritors. The following states do not require an Inheritance Tax Waiver.

It is only one of seven states that does not have an income tax. According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island and Tennessee. Does Florida require an inheritance tax waiver.

Does Oklahoma require an inheritance tax waiver. Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina Oregon South Carolina. Since Florida is on the above list the state does not require an Inheritance Tax Waiver.

There are no inheritance or estate taxes in Texas. Authorization to transfer real property is referred to as a release of lien. 3 Is a tax release also commonly known as an inheritance tax waiver required to be filed with the tax commissioner.

Estimation of ohio inheritance waiver form of. Final individual federal and state income tax returns. You do not need to draft another document.

All groups and messages. Waiver Of Inheritance Form Texas Limited to advise and so a waiver of inheritance form only be used for This is not inherit if i called a. 3 Does Social Security count inheritance as income.

Moreover what states require an inheritance tax waiver form. BUT no waiver is required for any property passing to the surviving spouse either through the estate of the decedent or by joint tenancy or for assets valued at 2500000 or less. The state repealed the inheritance tax beginning on September 1 2015.

Ohio Waiver required if decedent was a legal resident of Ohio. Can an inheritance affect social security benefits NewRetirement.

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

Texas Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Texas How To Discuss

Do I Have To Pay Taxes When I Inherit Money

States With An Inheritance Tax Recently Updated For 2020

Texas Inheritance Laws What You Should Know Smartasset

What Is An Inheritance Tax Waiver Question

States With No Estate Tax Or Inheritance Tax Plan Where You Die